Revenue Collections Batch Workflow

Revenue Collections uses the standard workflow process that allows authorized users in your organization to generate the edit and error listing, validate, approve, and post revenue collection batches. The Validation and Approvals icons may switch locations in the workflow list depending on the option selected in the Validation and Approval Sequence field on the Revenue Defaults tab on the Company Suite Settings page.

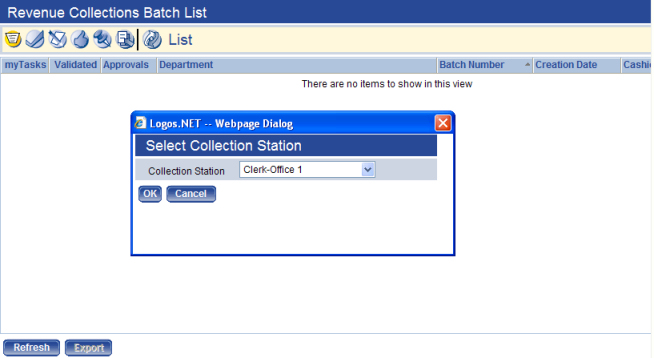

To access the Revenue Collections Batch List page, go to Financial Management > Revenue Collections > Receipts. The first time you access the Batch List page after logging in, the Select a Collection Station pop-up window displays where you must select a collection station to use when processing receipts. Click OK. ![]() Show me.

Show me.

Click the appropriate workflow button on the page corresponding to the action you want to perform.

Validation

Validation

The Revenue Collection Validation page allows authorized users to select the receipt batches to be validated. Validation is the system's way of "proofing" the batch to make sure no errors exist that would prevent the batch from posting (e.g., the G/L distribution associated with the receipt does not balance).

- Click the Validation

workflow button.

workflow button. - Select the top check box in the column header to validate all receipt batches or select the check box(es) next to the specific batch you want to validate. To select all list items across all pages, click the Select All button.

- Click Submit. If the batch is successfully validated, the list updates to display a check mark in the first column on the List page and ‘Valid’ displays after the Validation Results presented below the list.

- If the batch is not successfully validated, a reason displays after the batch in the Validation Results below the list and the list updates to display an X in the Validated column on the List page

If needed, click Reset to return the data in the fields to the state they were in when the page was last saved.

The Revenue Collection Print Edit & Error Listing page allow authorized users to produce an edit and error list of all receipt batches.

- Click the Print Edit & Error Listing

workflow button.

workflow button. - Select the top check box in the column header to print all batches or select the check box(es) next to the specific batch you want to print. To select all list items across all pages, click the Select All button.

- Click Show Preferences

to view additional output preferences you want to display on the listing.

to view additional output preferences you want to display on the listing.  Click here to show any of the check boxes you can optionally select:

Click here to show any of the check boxes you can optionally select:- Include Transaction Information – the transaction information associated with the receipt will be included on the listing.

- Include G/L Distribution Information – the G/L distribution information will be included on the report.

- Include Payment Information – the G/L distribution information will be included on the report.

- New Page for Each Batch – a new page is started for each receipt batch selected.

- Print Revenue Collection Payment Code Summary Listing – the Revenue Collection Payment Code Summary Listing will be sent to myReports.

- Print Receipt Distribution Listing – the Revenue Collection Receipt G/L Distribution Listing for the selected batches is sent to myReports.

- Print Receipt Deposit Report – the Revenue Collection Bank Deposit Listing for the selected batches is sent to myReports.

- Print Error Listing – the Revenue Collection Receipt Batch Error Listing for the selected batches is sent to myReports.

- Print A/R Sub Ledger Reports – multiple reports will be created for each sub ledger; the Miscellaneous Billing Payment Edit Report, the Miscellaneous Billing Waived Delinquent Charges Report, the Utility Management Payment Edit Report, the Utility Management Deposit Collection Report, and the Utility Management Waived Delinquent Charges Report are sent to myReports.

- Create Auditor Certificate – the Auditor Certificate Report for the selected batches is created as a PDF within the Revenue Collection Batch Documents page.

- Click Submit. The listing(s) is generated and sent to myReports.

If needed, click Reset to return the data in the fields to the state they were in when the page was last saved.

The Revenue Collection Approval page allows authorized users to select the receipt batches to be approved.

- Click the Approval

workflow button.

workflow button. - Select the top check box in the column header to approve all receipt batches or select the check box(es) next to the specific batch you want to approve. To select all list items across all pages, click the Select All button.

- Click Submit. If the receipt batch is successfully

approved, ‘Approval Added’ displays after the receipt batch number in the Approval Results presented below the list. The information in the Approval column in the List is updated to reflect the approval.

If the receipt batch is not successfully approved, the reason displays after the receipt batch number in the Approval Results that display below the list.

If needed, click Reset to return the data in the fields to the state they were in when the page was last saved.

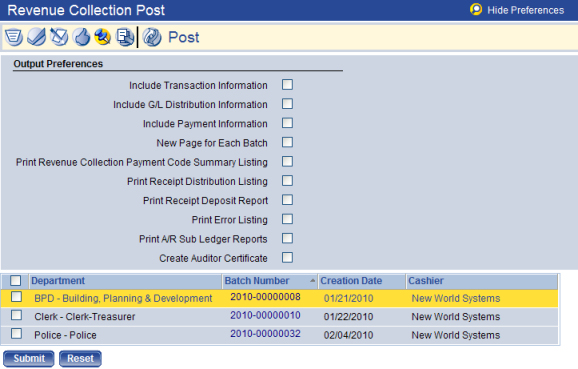

The Revenue Collection Post page allows authorized users to post receipt batches that have been validated and approved.

- Click the Post

workflow button.

workflow button. - Select the check box in the first column of the row to select the receipt batch to be posted. To select all batches to be posted, select the top check box in the column header.

- Click Show Preferences

to view additional output preferences you want to display on the listing. Optionally, you can select any of the following options:

to view additional output preferences you want to display on the listing. Optionally, you can select any of the following options:

Click here to show any of the check boxes you can optionally select

- Include Transaction Information – the transaction information associated with the receipt will be included on the listing.

- Include G/L Distribution Information – the G/L distribution information will be included on the report.

- Include Payment Information – the G/L distribution information will be included on the report.

- New Page for Each Batch – a new page is started for each receipt batch selected.

- Print Revenue Collection Payment Code Summary Listing – the Revenue Collection Payment Code Summary Listing will be sent to myReports.

- Print Receipt Distribution Listing – the Revenue Collection Receipt G/L Distribution Listing for the selected batches is sent to myReports.

- Print Receipt Deposit Report – the Revenue Collection Bank Deposit Listing for the selected batches is sent to myReports.

- Print Error Listing – the Revenue Collection Receipt Batch Error Listing for the selected batches is sent to myReports.

- Print A/R Sub Ledger Reports – multiple reports will be created for each sub ledger; the Miscellaneous Billing Payment Edit Report, the Miscellaneous Billing Waived Delinquent Charges Report, the Utility Management Payment Edit Report, the Utility Management Deposit Collection Report, and the Utility Management Waived Delinquent Charges Report are sent to myReports.

- Create Auditor Certificate – the Auditor Certificate Report for the selected batches is sent to myReports, when applicable.

- Click Submit to post the selected receipt batches.

If the batch is successfully posted, ‘Posted’ displays after the batch in the Post Results section presented below the list and the batch is removed from the Revenue Collections Batch List page.

If the receipt batch is not successfully posted, a reason displays after the batch in the Post Results section presented below the list on the Revenue Collections List page.

If needed, click Reset to return the data in the fields to the state they were in when the page was last saved.

Execute All Processes

Execute All Processes

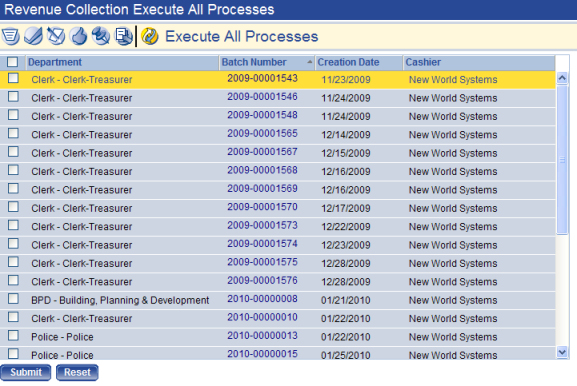

The Revenue Collection Execute All Processes page allows authorized users to easily and quickly process the receipt batch records through each step of the workflow in just one step.

- Click the Execute All Processes

workflow button.

workflow button. - Select the top check box in the column header to execute all processes on all receipt batches or select the check box(es) next to the specific batch on which you want to execute all processes.

- Click Submit to process the selected records through each step of the workflow process. When processing is finished, the status of each process is displays after the receipt batch number below the list. The information in the Validated and Approvals columns in the List are updated to reflect the update.

If the receipt batch is not successfully updated, the reason displays after the receipt batch number in the Results that display below the list.

If needed, click Reset to return the data in the fields to the state they were in when the page was last saved.

See Also

Revenue Collections Batch List